Looking Good Tips About How To Choose Risk Free Rate

How to choose the terms of risk free rate in order to price a call option.

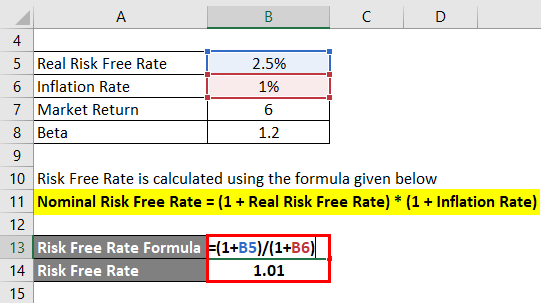

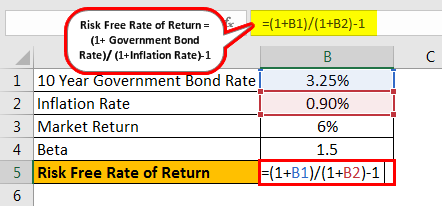

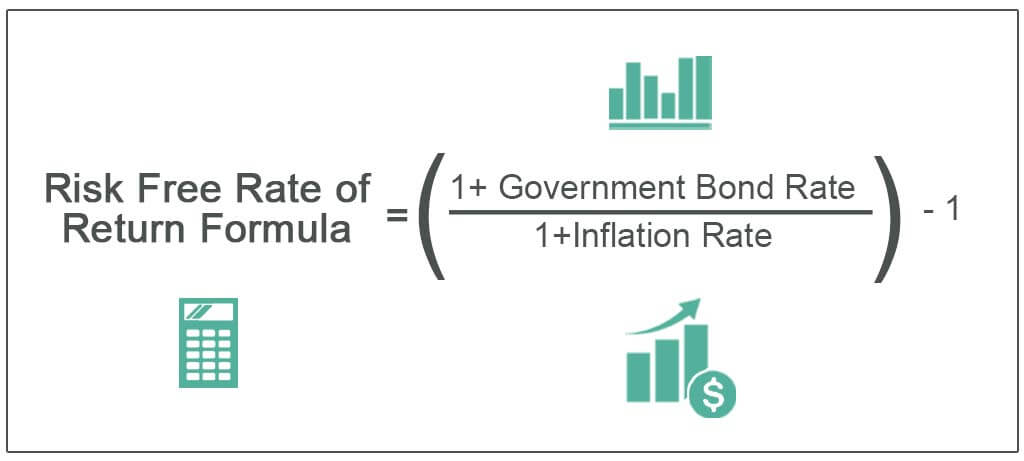

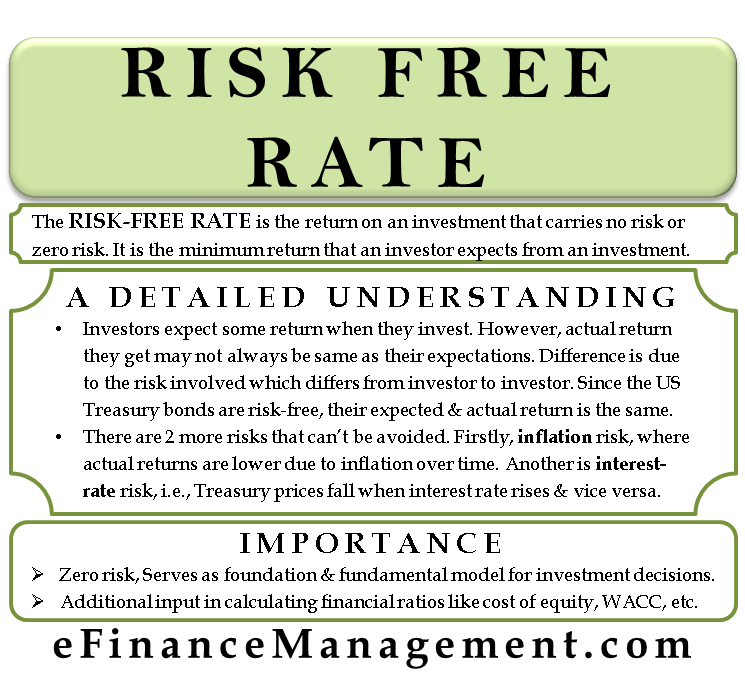

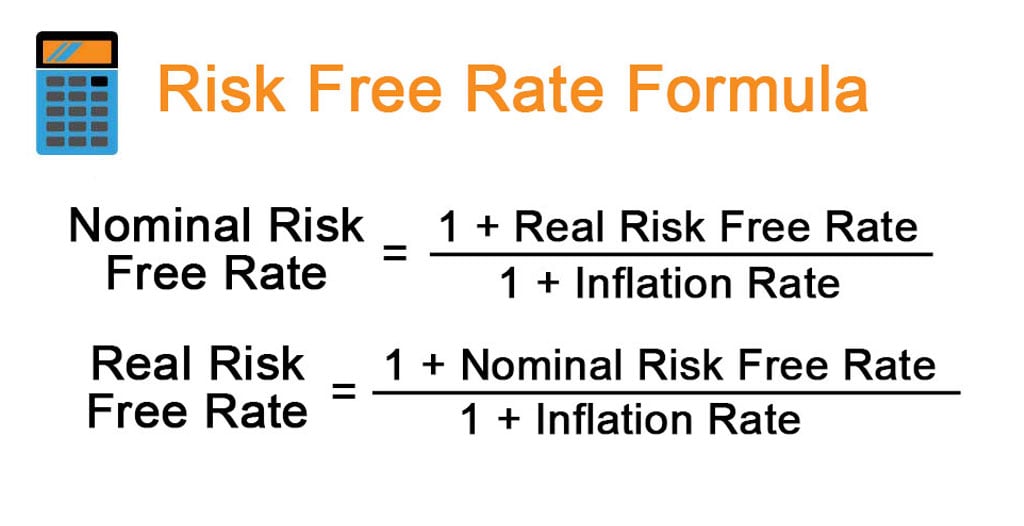

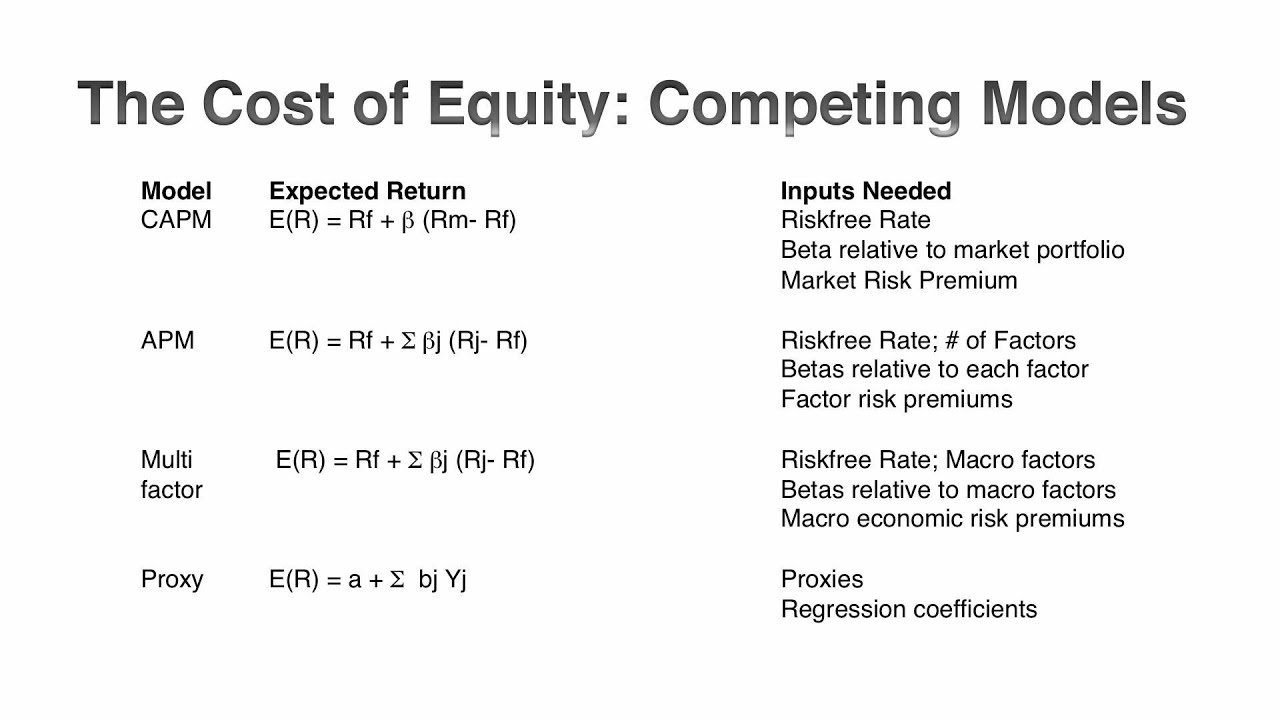

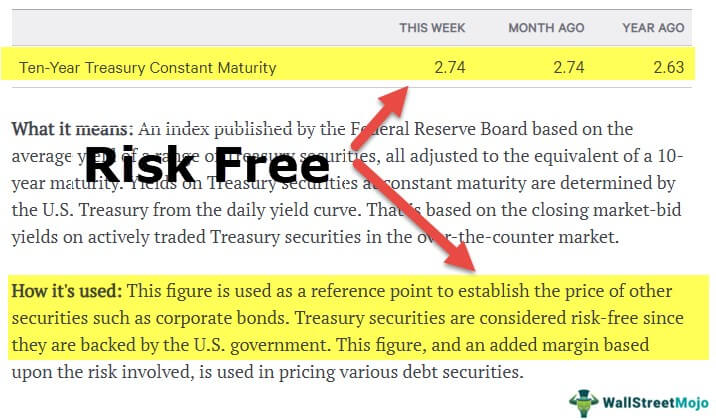

How to choose risk free rate. Ask question asked 10 months ago. Starting from the 1y bond, we use the relation. Models of risk and return in finance start off with the presumption that there exists a risk free asset, and that the expected return on that asset is known.

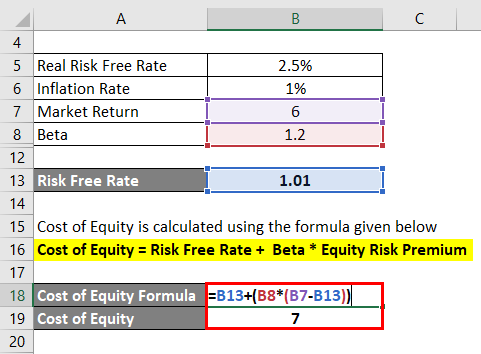

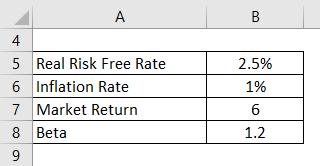

Inflation rate expected 5% and tips is 1%, therefore the. The below numbers are pulled from dec. In other words, it is possible, by knowing the.

There are two characteristics that you should look for in a risk free rate: At least in standard version of the capm is not possible to have more than 1 risk free rate, in fact. In the above capm example, the.

Let’s look at an example.

/dotdash_Final_How_Risk_Free_Is_the_Risk_Free_Rate_of_Return_Feb_2020-96f00395de3d40668f31522801756339.jpg)

%2013.29.22.png)