Awesome Info About How To Check Your Credit Score Without A Card

Credit card issuers usually let you qualify for at least a secured credit card even without a social security number.

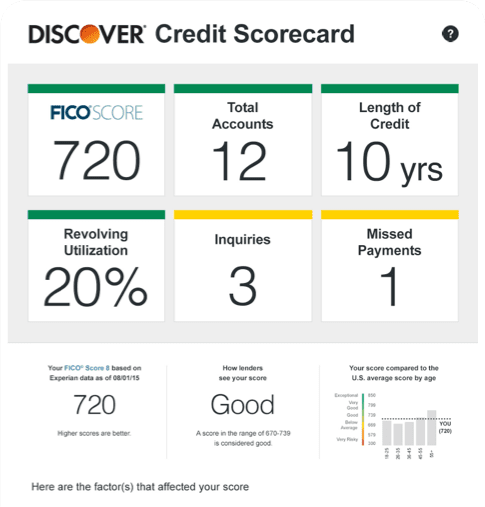

How to check your credit score without a credit card. If you want even more insight into your credit, check out extracredit. See what's impacting your credit score. The higher this ratio the slower it will be to build.

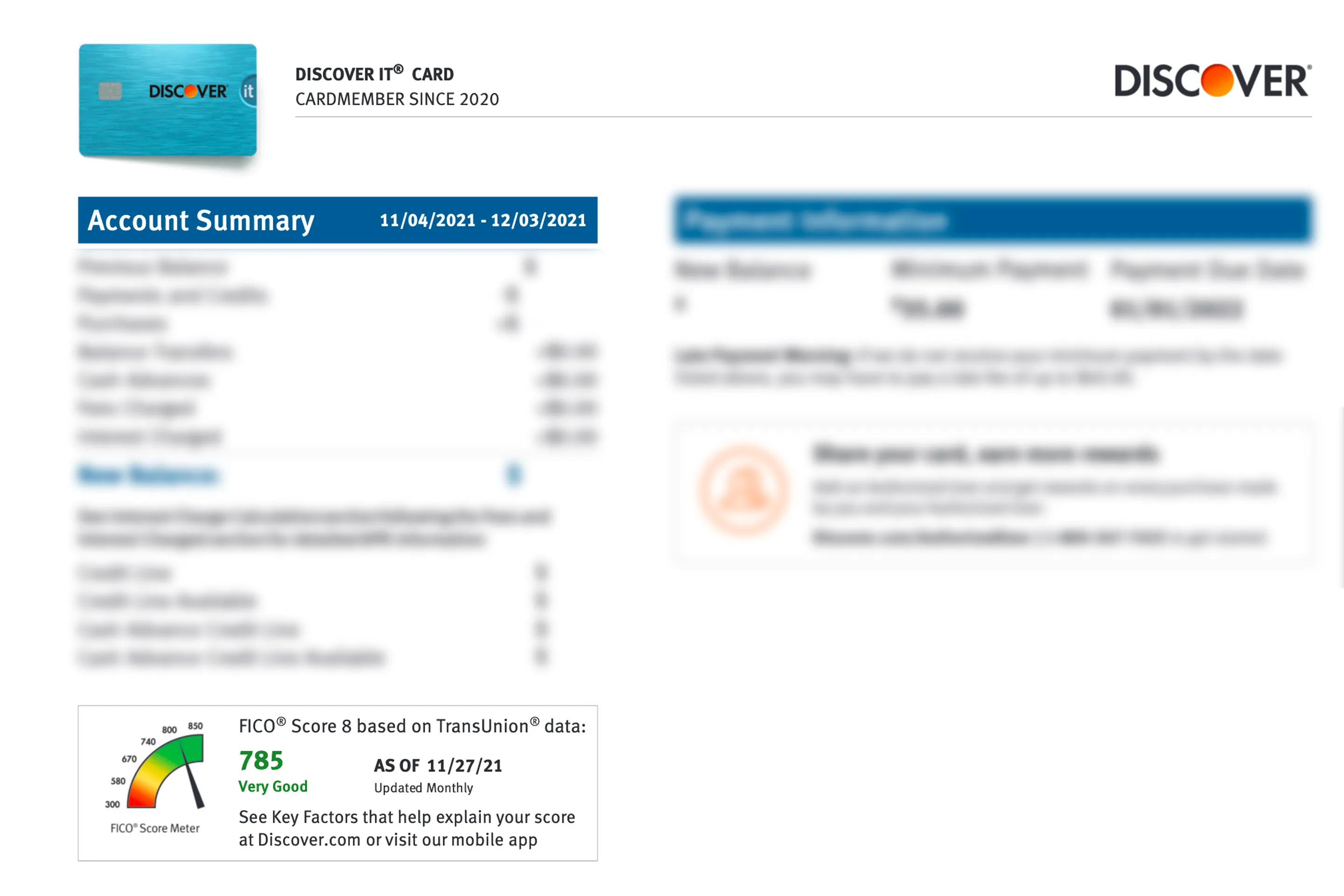

Contact your credit card issuers. Checking credit reports can help you spot inaccuracies that could be holding down your score, or they can alert you to potential fraud or. Ad what will your score reveal?

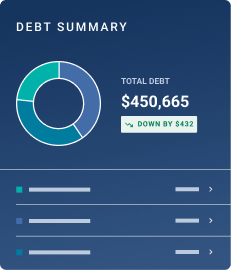

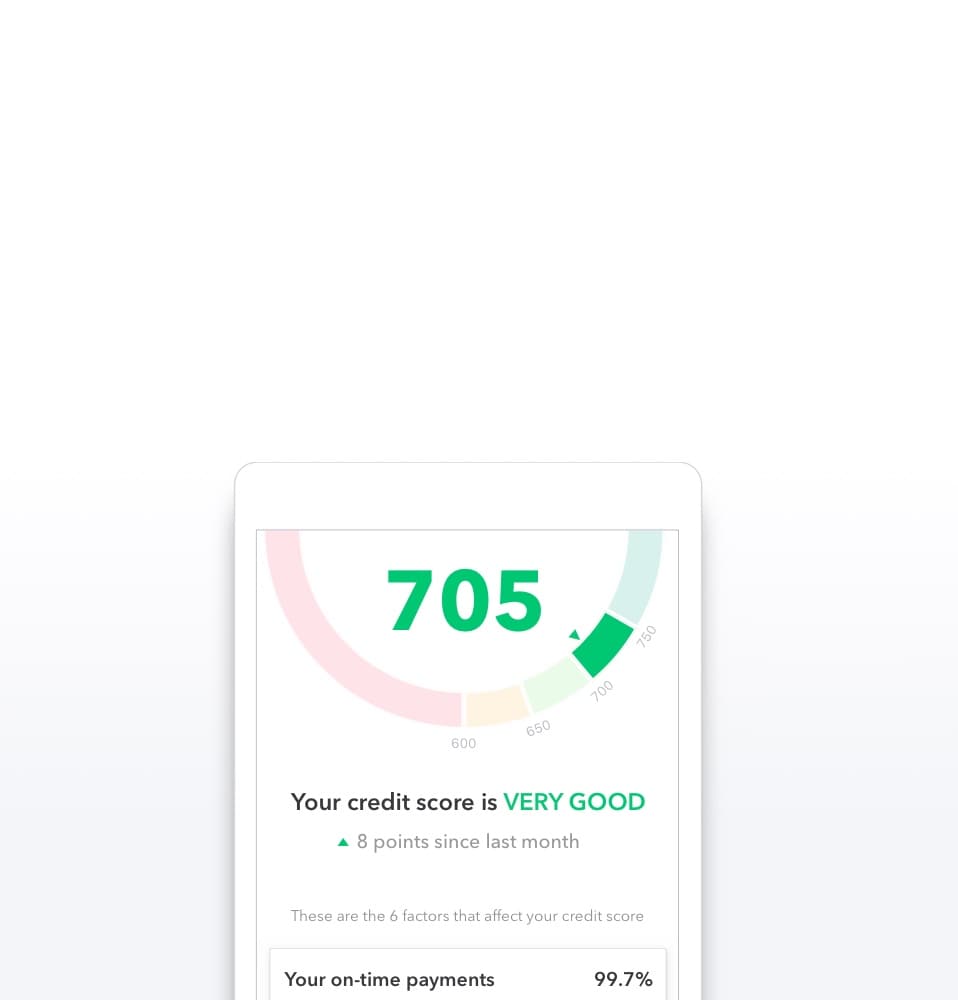

But first, let’s learn what an. Verify that your account balance is zero. A free credit score is great tool for understanding, tracking, and building your credit.

I don’t see the need for the other card plus waiving/paying the monthly mf for the other card is such a hassle. This is yet another way by which you can get your hands on a credit card with a bad or no cibil score at all. You can have a credit score without a credit card if you’ve taken out a loan, had rent payments reported to the major credit bureaus, or fallen behind on other bills.

This is the lowest cibil score range. One of the most versatile and accessible ways to borrow money with bad credit is via a personal installment loan. Credit card companies are not the only ones that report your payment and usage history to the three credit bureaus.

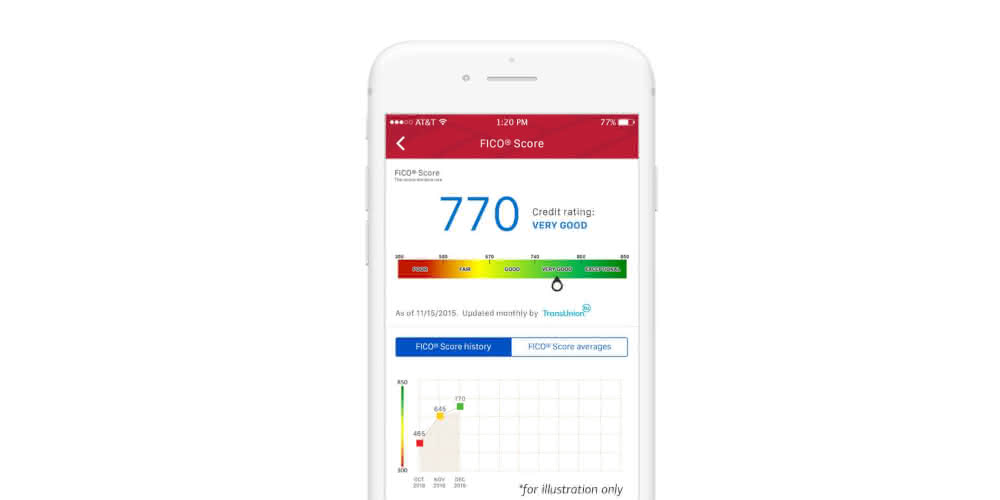

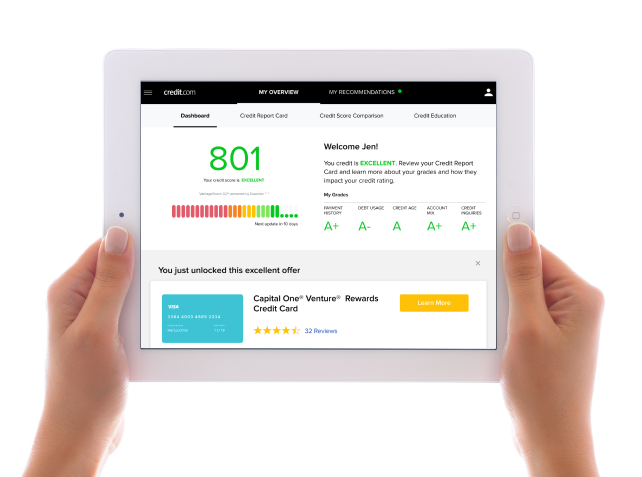

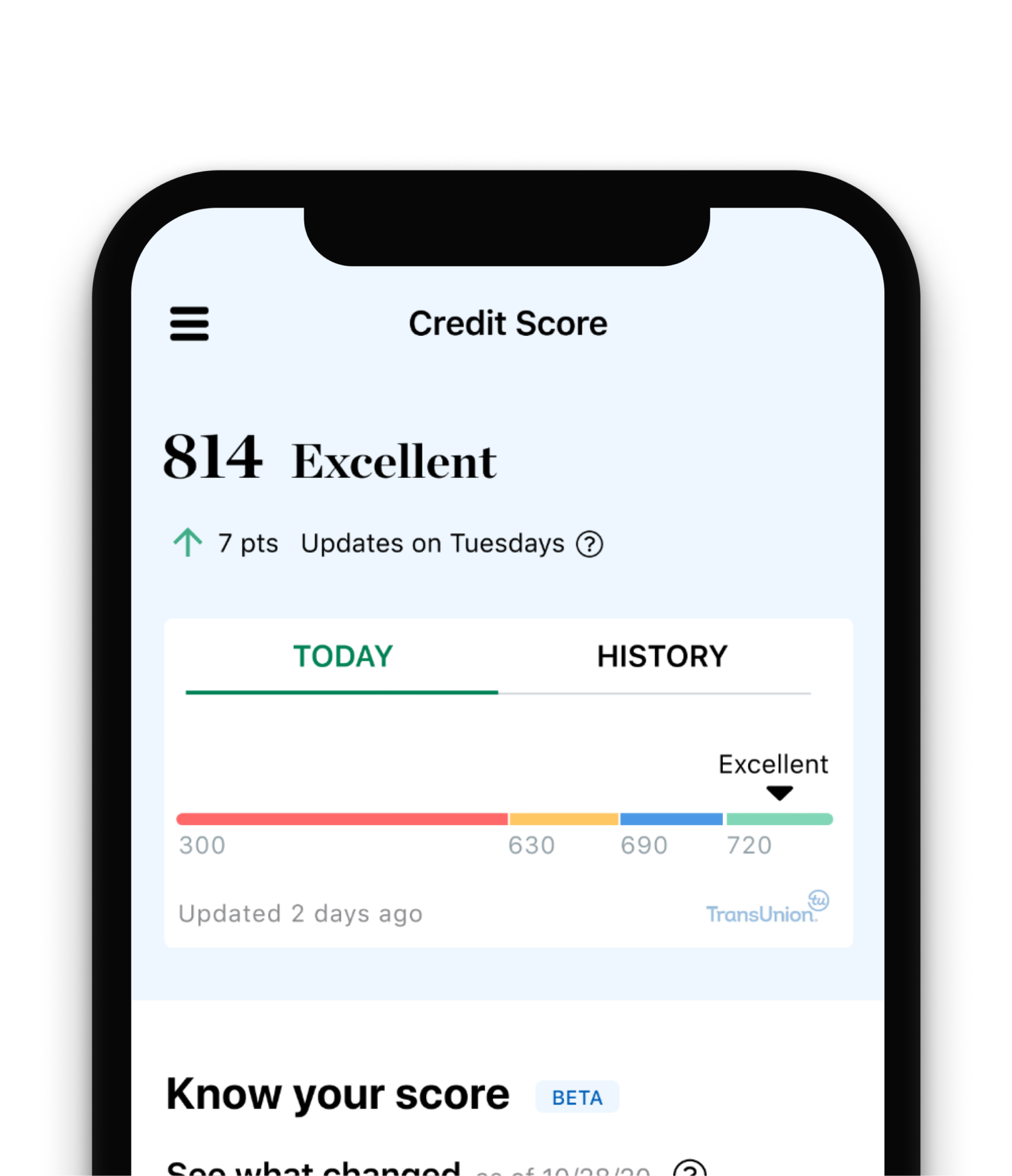

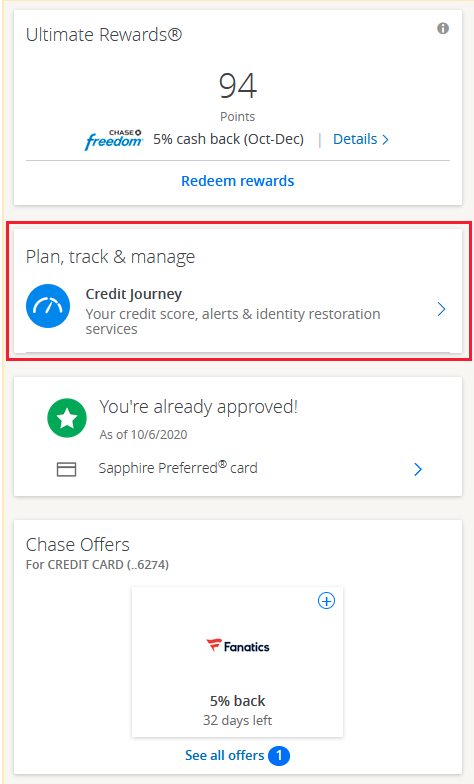

Credit scores aren't impacted by checking your own credit reports or credit scores.in fact, regularly checking your credit reports and credit scores is an. See your free credit score & report in only 90 seconds. Ad fast and easy access to your credit report.

Earn 70,000 bonus miles after you spend $4,000 on purchases in the first 3 months your account is open. If your credit profile is lacking sufficient history, or if you have a poor score, a credit builder loan is a great way to establish new credit or improve bad credit. My question is will it affect my credit score if i cancel the other one?

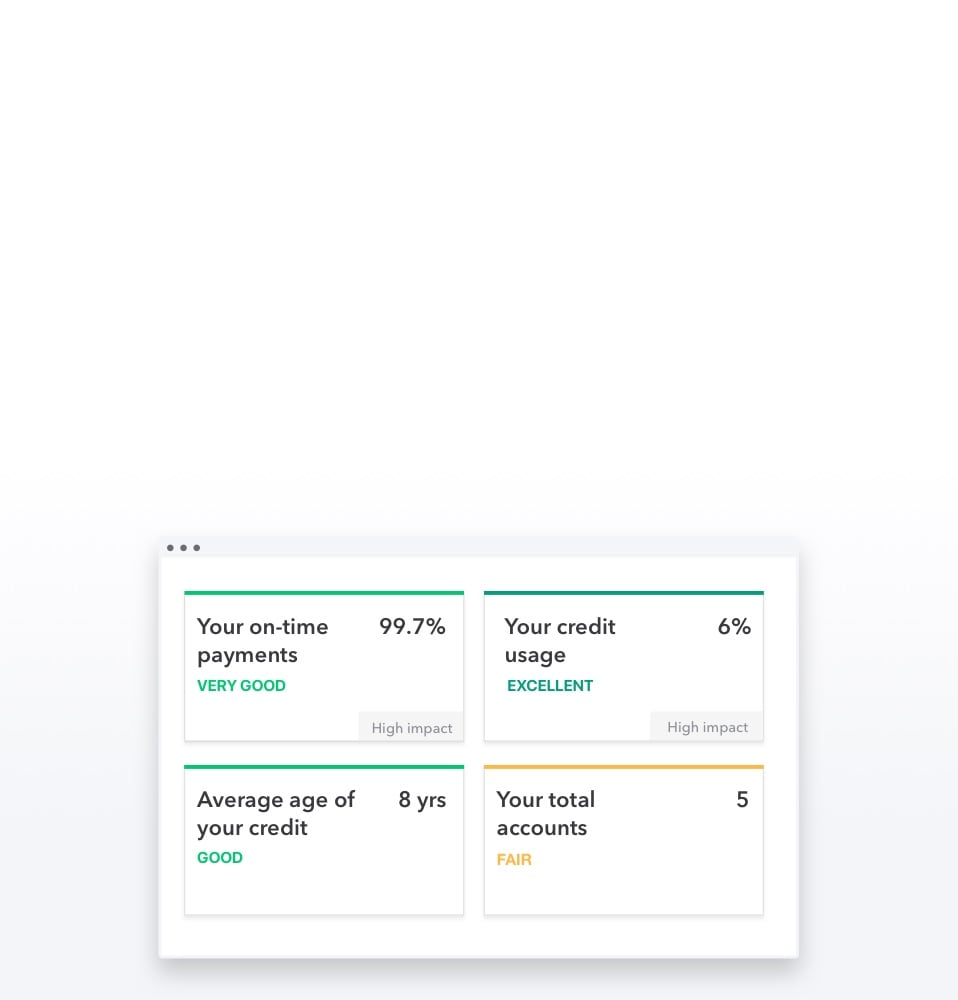

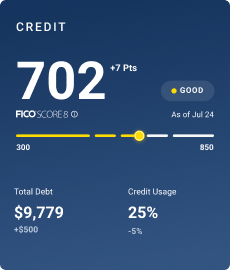

Ad join the millions of people that credit sesame has helped reach their financial goals. Ad fast and easy access to your credit report. If you have credit cards, this means not using more than 30% of your credit limit at any given time—credit experts say a utilization rate that's any higher will hurt your credit score.

If you want to take a look at your credit history and check your credit scores, the best way to start is from your credit report. It’s a good idea to keep this number below 30%, and ideally below 10%. Get your free annual credit report.

Ad increase your credit scores & get credit for the bills you're already paying. From there, you can proceed to prove your responsibility with. See & monitor your score now.