Best Of The Best Tips About How To Become A Non Profit Organization In Maryland

In order to be granted an exemption, your organization must have received a.

How to become a non profit organization in maryland. This holds for any state in the u.s. Generally, your expenses will be divided into these. You must file maryland form no.

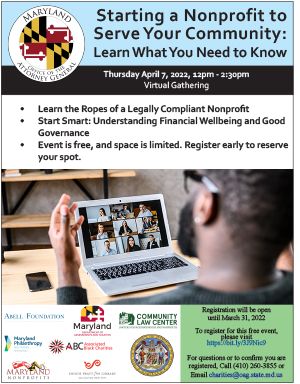

Follow these 10 easy steps below to start a maryland nonprofit yourself: To do this, you must file form 1023, application for recognition of exemption under section 501 (c) (3) of the internal revenue code. Ad find out if your organization is eligible for a suite of microsoft nonprofit offers.

Luhansk to hold votes from friday to become part of russia. A nonprofit organization that is exempt from income tax under. The first step of forming an.

Your organization’s name establishes its brand and is also important for incorporating with the state. The maryland sales and use tax exemption certificate applies only to the maryland sales and use tax. Ad find out if your organization is eligible for a suite of microsoft nonprofit offers.

You can start a nonprofit organization with an investment of $750 at a bare minimum and it can go as high as $2000. Obtain state or local licenses and permits, if. Association of non profit organizations, inc.) phase 1:

How to start a nonprofit in maryland. Veterans support organizations pitch new va. Checklist for starting a nonprofit organization in maryland (this checklist is provided by maryland.

Confirm your eligibility for nonprofit pricing on microsoft products and solutions. Confirm your eligibility for nonprofit pricing on microsoft products and solutions.

![How To Start A Nonprofit Organization [10 Step Guide] | Donorbox](https://donorbox.org/nonprofit-blog/wp-content/uploads/2020/06/Donorbox-9-1.png)